As the only free trade port in China, the Hainan Free Trade Port (Hainan FTP) is designated as a national-level str...

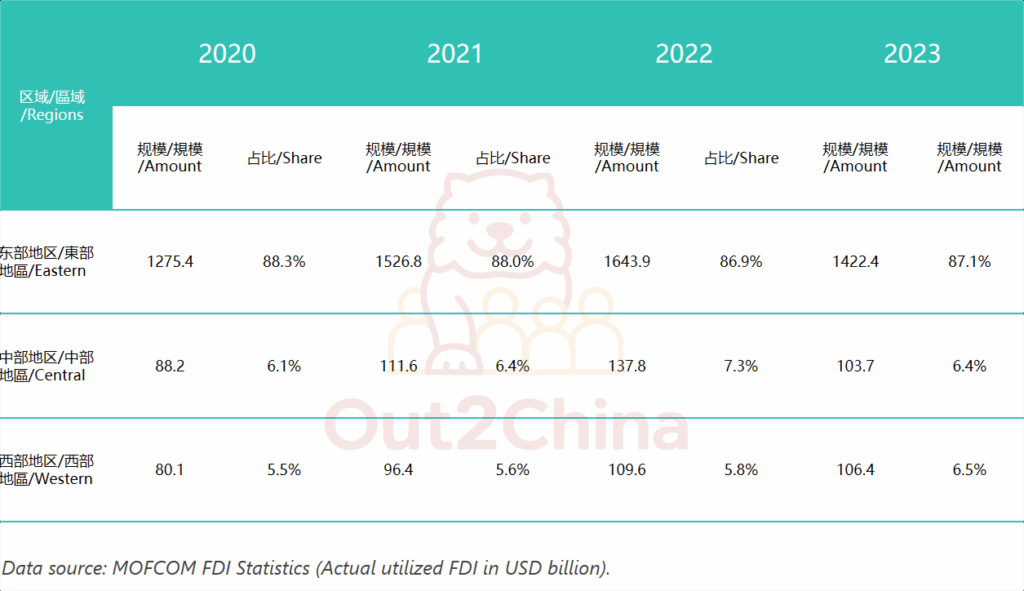

China's economic growth is underpinned by its vast market scale. As the world's second-largest economy, it accounts for approximately 18% of global GDP—a share that continues to expand, making it a force to be reckoned with. For international enterprises, developing an effective market entry strategy is essential to capitalize on opportunities. Despite its vast territory and a huge population, China experiences an uneven regional development. Significant disparities exist across provinces in industry and talent pools. We will next introduce industry concentration in different regions of China, offering multinational corporations data-driven insights. China’s economic development shows significant regional disparities, particularly between the eastern, central, and western regions. Eastern Region: Economic, technological, and financial hubs are concentrated in cities like Shanghai, Beijing, and Shenzhen, attracting a large number of foreign enterprises. These markets are well established with strong purchasing power and intense market competition. For foreign businesses, the advantages of eastern region lie in its high-end market, innovation, and high internationalization. Central Region: Cities such as Wuhan, Changsha, and Zhengzhou have become new economic engine in manufacturing, logistics, and technological innovation, with tremendous growth potential. With relatively low labor costs, central region has attracted foreign investment and become cost-effective alternative markets. Western Region: Cities like Chengdu, Xi’an, and Chongqing have received significant infrastructure investments through the "Belt and Road" initiative in recent years, but market size and residents' income are still in developing phase. Western region is suitable for industries like manufacturing and infrastructure development. Its demand for high-end consumer goods and technological products is relatively low. Different regions exhibit difference in industrial structures, with distinct industry clusters across cities. Foreign firms should carefully align their products and sizes with cities. Four Key Cities: Shenzhen – The high-tech powerhouse of China, specializing in IT, semiconductors, electronics, telecommunications, biomedicine etc. As the nation's innovation hub, Shenzhen attracts cutting-edge enterprises and talents, making it ideal for technology-driven, R&D-focused, and advanced manufacturing firms. Shanghai – China's financial, shipping, and commercial center, with dominant clusters in finance, trade, and high-end services—particularly fintech and information services. With high internationalization, Shanghai is the premier gateway for foreign businesses entering China. Beijing – Beijing advantageous industries are technology innovation, education, culture, and information. Beyond being China's political and cultural heart, Beijing is also home to internet giants, AI firms, and R&D centers. Guangzhou – A manufacturing and foreign trade hub, blending traditional industries (e.g., automotive, home appliances, consumer goods) with modern services (e.g., logistics, cross-border e-commerce). Optimal for cost-sensitive production and e-commerce-driven market entry strategies. Key Locations: Still don’t know how to choose your entry city? Welcome to contact out2china, and talk your market aim. We will help you enter Chinese market efficiently with the fittest solutions. With 28 years of experience, Out2China fully understands overseas firms' needs to build an operational system. We specialize in China market entry and have served hundreds of companies across multiple industries. We provide one-stop offshore team solutions, helping Enterprises Efficiently Enter the Chinese Market. From human resource support to payroll and tax compliance management, we provide comprehensive support for your team to enter the Chinese market.

Outline: Chinese Economy of Eastern, Central and Western regions

Cities: Map of Industry Hubs

Province/Municipality Key Cities Favorable Policies Major Industries Guangdong Shenzhen, Guangzhou, Dongguan - Qianhai/Nansha FTZ;

- Cross-border capital flow policiesTech, Electronics Manufacturing, Cross-border E-commerce, Semiconductors, Biomedicine, Automotive Manufacturing, Telecom, Drones Jiangsu Suzhou, Nanjing, Wuxi - Cost of industrial land 30% below Shanghai

- Suzhou one-stop FDI approvalHigh-End Manufacturing, Medicine, R&D, Electronics, Semiconductors, IoT, IC Shanghai Shanghai - Lingang FTZ supports full foreign ownership Automotive, Tech, Finance, Shipping, Biomedicine Zhejiang Hangzhou, Ningbo - Hangzhou E-commerce Pilot Zone- Expedited customs

- Ningbo: fastest export tax rebatesE-commerce, Digital Services, Manufacturing, Textiles, Logistics, Green Petrochemicals Sichuan Chengdu - China-Europe Railway Express

- Low labor costsElectronics, Airline, Gaming, Baijiu (Liquor), Food Processing Hubei Wuhan - 4-hour high-speed rail access to major cities Optoelectronics, Automotive Component, Pharmaceutical R&D, Healthcare Tianjin Tianjin - Incentives of FTZ aircraft leasing tax

- Proximity to BeijingAerospace, Chemicals, Finance

Welcome to Consult

As the only free trade port in China, the Hainan Free Trade Port (Hainan FTP) is designated as a national-level str...

China has become the world’s second-largest healthcare market. Yet for overseas pharmaceutical and medical device compan...